Amit Gandhi

Affordable Care Act

Confused by the Affordable Care Act and its requirements?

Our experienced team of healthcare advisors offers personalized assistance, ensuring you navigate your options smoothly and secure the most affordable and comprehensive coverage.

Amit Gandhi

The Affordable

Care Act

Confused by the Affordable Care Act and its requirements? Our experienced team of healthcare advisors offers personalized assistance, ensuring you navigate your options smoothly and secure the most affordable and comprehensive coverage.

Helping You To

Manage Your ACA

Needs!

I'm Amit Gandhi, your dedicated ACA Health Insurance & Benefits Broker with a passion for simplifying the complex world of health insurance.

With over 15+ years of experience, I've assisted individuals and families in navigating the intricacies of healthcare coverage, ensuring they find the perfect plan to suit their unique needs.

___________________

Why Choose Me as Your Health Insurance Advisor?

✅Expert Guidance:

I stay abreast of the latest healthcare trends and insurance options, providing you with expert advice tailored to your situation.

✅Personalized Solutions:

Your health and well-being are unique. I take the time to understand your specific requirements and tailor insurance solutions that fit your life.

✅Advocacy:

I'm not just here to sell insurance;

I'm your advocate in the complex healthcare landscape.

I'm committed to ensuring you get the coverage you deserve.

As the Annual Open Enrollment Period for 2025 Health Insurance coverage is underway, now is the perfect time to review your options and make informed decisions.

Don't navigate the process alone—let me guide you.

Independent ACA Health Insurance Broker | Advisor

NPN: 10212358

About Us

Helping You To

Manage Your ACA

Needs!

Amit Gandhi

MBA, Certified Wealth Preservation Planner (CWPP™),Certified Asset Protection Planner (CAPP™)

10212358

Key Points You Need To Know

About

Affordable Care Act

(At A Glance)

What is the Affordable Care Act?

The Affordable Care Act (ACA) is a 2010 law aimed at increasing the affordability and accessibility of health insurance, expanding Medicaid coverage, and reducing overall healthcare costs.

Determining Eligibility

Most people who enroll in health insurance through the marketplace are eligible for financial help.

Advanced Premium Tax Credits (APTC) lower up-front monthly premiums

and

Cost-Sharing Reductions (CSR) lower deductibles, copayments, and other costs when people use their insurance.

What is a Qualified Health Plan?

Insurance plans available in the marketplaces are known as Qualified Health Plans (QHPs).

All QHPs hold the 10 Essential Health Benefits

1. Ambulatory patient services (outpatient care you get without being admitted to a hospital)

2. Emergency services

3. Hospitalization (like surgery and overnight stays)

4. Pregnancy, maternity, and newborn care (both before and after birth)

5. Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

6. Prescription drugs

7. Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

8. Laboratory services

9. Preventive and wellness services and chronic disease management

10. Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

Additionally, Plans must include:

- Birth Control Coverage

- Breastfeeding Coverage

Essential health benefits are minimum requirements for all Marketplace plans.

Specific services covered in each broad benefit category can vary based on your state’s requirements.

Plans may offer additional benefits, including:

Dental coverage

Vision coverage

Medical management programs (for specific needs like weight management, back pain, and diabetes)

Contact us to compare your plan options and you'll see exactly what each plan option has to offer.

They all have provider networks, though each plan usually has its own unique network

They all have premiums and cost-sharing charges, though the actual amount a person pays will depend on whether they’re eligible for financial help

Changes to Special Enrollment Period

HealthCare.gov enrollees with incomes up to 150% of the Federal Poverty Limits (FPL) will continue to have a year-round special enrollment opportunity, though this is optional for state-based marketplaces. However, the “Medicaid Unwinding” special enrollment period is ending November 30, 2024.

In addition, starting in 2025, all consumers who choose an ACA Marketplace plan during a special enrollment period (whether a federal or state-based marketplace) will have their coverage begin on the first day of the month following their plan selection.

(In the past, in some state-based Marketplaces, if a consumer chose a health plan during a special enrollment period after the 15th of the month, coverage began on the first day of the second month.)

Important Details

The enrollment periods are designated times each year when people can sign up for health insurance, including an annual open enrollment and special periods for qualifying life events.

When is the Annual Open Enrollment Period for 2025 Coverage?

Open enrollment is from November 1, 2025 to January 15, 2025 in Texas.

Consumers who select a plan

by midnight December 15, 2025

(5 a.m. EST on December 16)

can get full-year coverage that

starts January 1, 2026.

Consumers who select a plan

after December 15, 2025,

but

before the deadline in January 2026.

can have coverage that

is effective on: February 1, 2026.

This could be the last year of enhanced subsidies.

Enhanced subsidies under the Inflation Reduction Act (IRA) are set to expire at the end of 2025. Initially introduced in the American Rescue Plan Act, these subsidies increased premium support for existing enrollees and expanded eligibility to those earning above 400% of the poverty level.

These subsidies, which have driven the record-high enrollment in Marketplaces, will remain in place for the duration of 2025, but would require an act of Congress to extend them in 2026 or beyond.

If these enhanced subsidies expire, the original ACA subsidies will remain in place but premium payments (net of subsidies) are expected to double or more in a number of states in 2026.

Marketplace shoppers will have more choice of insurers

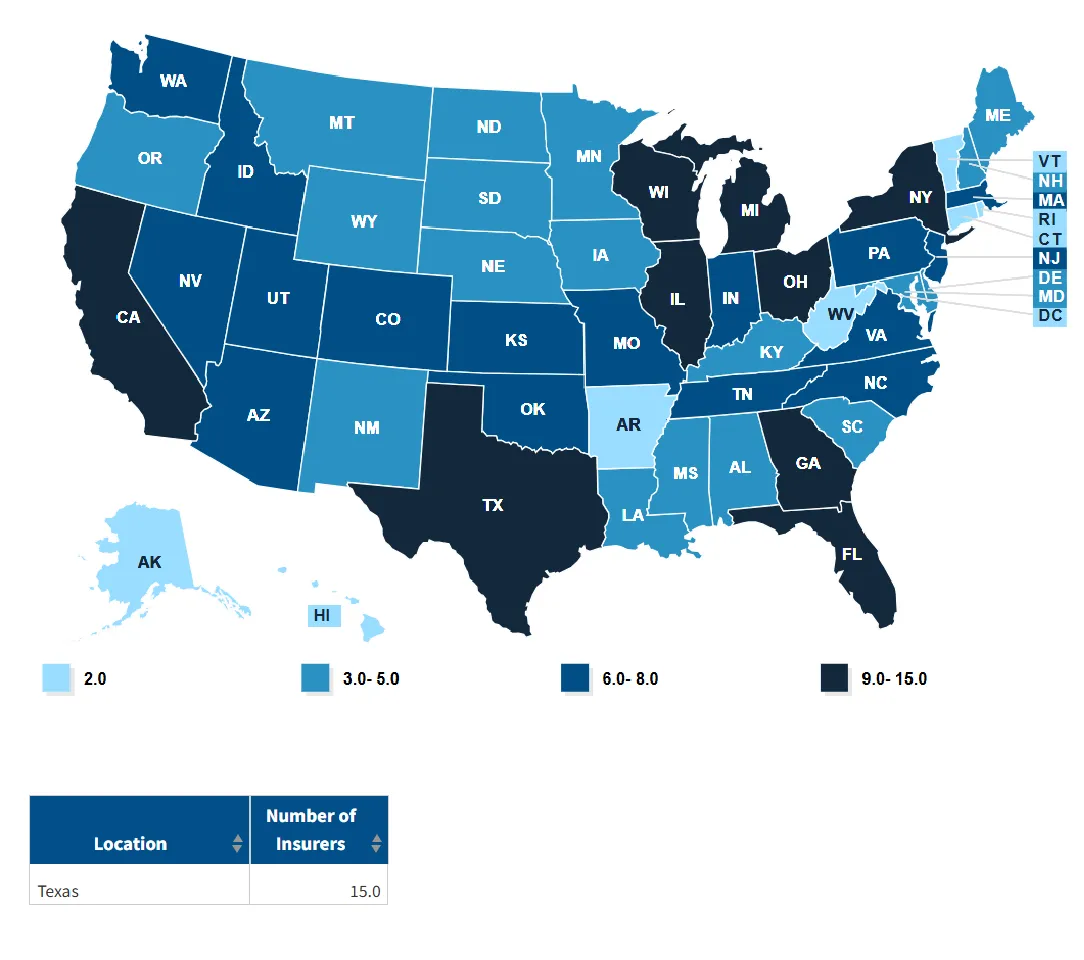

On average, across states, 9.6 insurers are participating on the ACA Marketplaces, which is higher than in any prior year (state data are here). With Texas holding highest number of 15 insurers participating in the ACA Marketplace.

Source: Analysis of data from Healthcare.gov , Robert Wood Johnson Foundation, and a review of state rate filings.

Notes: Data reflect insurers participating in the individual market only, and do not include SHOP or stand-alone dental plan insurers. Insurers are grouped by parent company or group affiliation, which were obtained from HHS Medical Loss Ratio public use files, Mark Farrah Associates data, and supplemented with additional research, including insurer press releases and healthinsurance.org.

Definition:

Insurer: An issuer of an Individual Qualified Health Plan (QHP) through the State-based and Federally-facilitated Health Insurance Marketplaces (Marketplace plans). Insurers offering QHPs through the Marketplace in multiple states are counted once in each state in which they offer a QHP. Parent companies of insurers are counted in place of each subsidiary, where applicable.

Changes to short-term plans are taking effect.

The Biden Administration is reversing the Trump Administration’s expansion of short-term health insurance plans that are not ACA-compliant and can discriminate against people with pre-existing conditions.

The new rules require that short-term plans be limited to 4 months total, and must now come with a consumer notice in all online and written marketing, enrollment application and other materials stating that the coverage “is NOT comprehensive health coverage.”

Everything You Need To Know About ACA

At A Glance

What is the Affordable Care Act?

The Affordable Care Act (ACA) is a 2010 law aimed at increasing the affordability and accessibility of health insurance, expanding Medicaid coverage, and reducing overall healthcare costs.

Important Details

The enrollment periods are designated times each year when people can sign up for health insurance, including an annual open enrollment and special periods for qualifying life events.

Reviews

Real-Life Testimonials

From Satisfied Clients

Vatsal B.

Amit and 108 Capital Management firm are very knowledgeable , professional and punctual ,they go beyond and above to help escalate your financial needs ,one thing I greatly appreciated from Amit is his prompt response to any of my inquiries, I highly recommend their financial services .

Priyanka M.

Amit is incredibly knowledgeable and professional when it comes to health insurance. He took the time to patiently explain all the options and answered every question I had, no matter how small. Amit genuinely cared about finding the best plan to fit my requirements. His responsiveness and attention to detail made the process stress-free and efficient. I highly recommend Amit to anyone looking for trustworthy and reliable guidance with health insurance.

Diana B.

We have worked with Amit multiple times, and always have a great, seamless experience. Amit is the type of person who will go the extra mile to ensure the loan process is as simple and straightforward as possible. Additionally, he is very knowledgeable and and answers all our (many) questions, allowing us to feel confident that we are choosing the option that works best for our specific situation. And of course, he'll do whatever is on his power to ensure we close on time!

Reviews

Real-Life Testimonials

From Satisfied Clients

More Info

Important Questions

What Should I Budget for Health Insurance?

You should choose the Bronze or Silver plans if you need to save money, or the Gold or Platinum plans if you have a larger budget and expect to need frequent healthcare services.

Can I Work with My Preferred Doctor?

Yes absolutely, but please ensure that your preferred doctors and hospitals are in-network to avoid high out-of-pocket costs.

Prescription Drug Needs

Choose a plan that effectively covers your medication requirements. If you are unsure which plan to choose, you can schedule a free consultation call with one of our experts below.

I Need Help Paying for Health Insurance

Premium subsidies are available for incomes between 100% and 400% of the federal poverty level; you can check your eligibility on the Health Insurance Marketplace.

How do I Sign Up?

For more detailed information and personalized assistance, schedule an appointment with me today. I can guide you through the process, help you understand your options, and ensure you find a plan that meets your needs and budget. Schedule an appointment now to get started on securing your health insurance coverage.

More Info

Important Questions

What Should I Budget for Health Insurance?

You should choose the Bronze or Silver plans if you need to save money, or the Gold or Platinum plans if you have a larger budget and expect to need frequent healthcare services.

Can I Work with My Preferred Doctor?

Yes absolutely, but please ensure that your preferred doctors and hospitals are in-network to avoid high out-of-pocket costs.

Prescription Drug Needs

Choose a plan that effectively covers your medication requirements. If you are unsure which plan to choose, you can schedule a free consultation call with one of our experts below.

I Need Help Paying for Health Insurance

Premium subsidies are available for incomes between 100% and 400% of the federal poverty level; you can check your eligibility on the Health Insurance Marketplace.

How do I Sign Up?

For more detailed information and personalized assistance, schedule an appointment with me today. I can guide you through the process, help you understand your options, and ensure you find a plan that meets your needs and budget. Schedule an appointment now to get started on securing your health insurance coverage.

Looking for a First-Class ACA Consultant?

Looking for a First-Class ACA Consultant?

108 Capital Management is committed to serving you at the highest level with all your Healthcare needs.

National Producer Number: 10212358

Company

Directories

Legal

108 Capital Management is committed to serving you at the highest level with all your Healthcare needs.

National Producer Number: 10212358

Company

Directories

Legal